The biggest side-effect of the Fed’s aggressive tightening - apart from causing a recession - is the strong dollar, which Ruchir Sharma has described as a wrecking-ball, in this piece for FT (free for Pro subscribers). The upshot -with the expected slowdown in profit growth and the associated contraction in P/E multiples- is that real longer-run stock returns are likely to be notably lower than in the past,” she writes. “With a rise in risk-free rates (due to Fed’s aggressive interest rate hikes) and falling profits, there is good reason to believe that P/E multiples, which averaged over time, will themselves contract. In a similar vein, my colleague Neha Dave writing today cautions investors about getting caught in bear market rallies. Their portfolios also need to reflect the realities of an approaching profits recession,” writes Richard Bernstein, chief executive and chief investment officer of Richard Bernstein Advisors. “Investors should resist the knee-jerk reaction of rushing to speculative assets based solely on the Fed potentially reversing course. However, it’s not all about the Fed, argues this FT article (free to read for Pro subscribers). MC Explains | How oil prices erupted & tumbled to rise again All this breathless tracking of Fed officials of clues to what they might do next has led to short-term volatility in the market. With the S&P500 in bear territory, any actual pivot or rise in expectations of one could lead to a rally, but that is likely to be short-lived. US consumer price inflation numbers are due on Thursday, but the labour market report has all but squashed talk of a Fed ‘Pivot’ which had gained steam during recent days. Equity markets also have to contend with the fact that September quarter earnings are likely to be weak, with margin pressures in several industries. Domestic equity markets also opened as much as 1.6 percent lower before recovering mid-day, although they are still in the red. With crude oil too shooting past $97 a barrel, the rupee plunged to a fresh low of 82.72 to a dollar. US 10-year treasury yields inched close to 4 percent and investors made a beeline for dollar assets. That seems to seal the deal for yet another 75 basis points rate hike by the US Federal Reserve Open Market Committee when it meets on November 1. The latest jobs report from the US shows a red hot labour market with unemployment dropping to 3.5 percent. Unlocking opportunities in Metal and Mining.

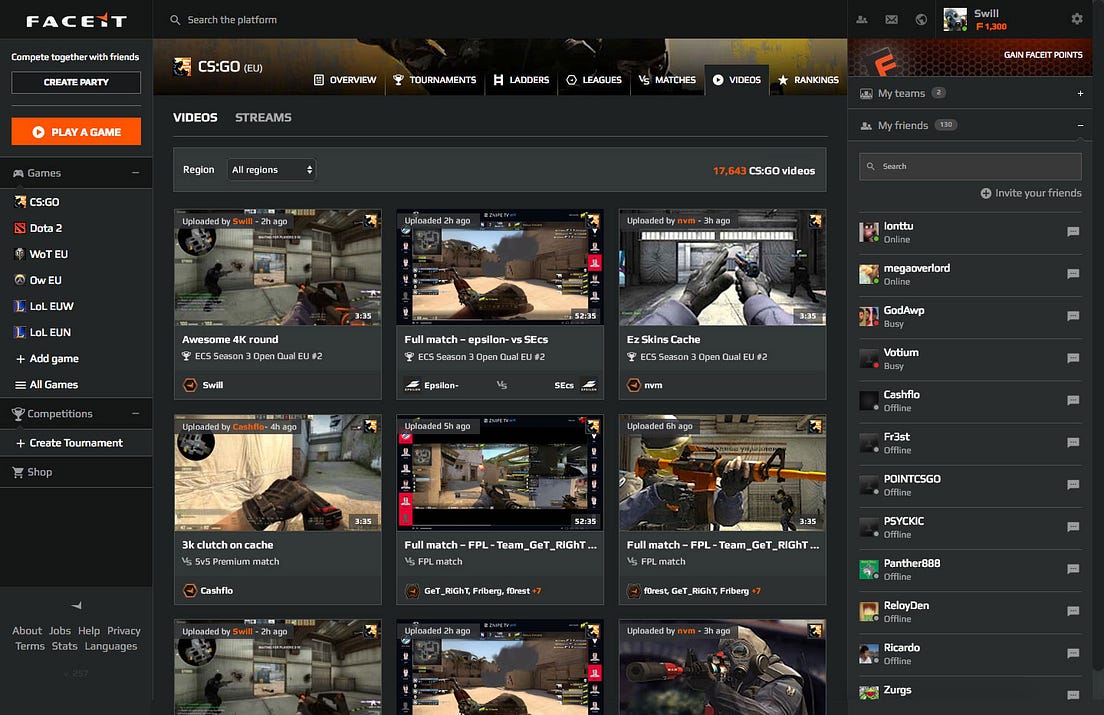

Faceit download series#

Interview Series Business In The Week Ahead.

0 kommentar(er)

0 kommentar(er)